Expanding Venture Pipeline to Seed Stage Startups Shows Early Gains for Inclusion

When we launched the SoCal Venture Pipeline back in April 2021 we focused on helping startups seeking Series A funding because the data showed that many promising SoCal startups were failing largely due to the lack of local VC firms able to write a $4M check. Nearly a year into the program we have helped some amazing startups get funded but we were not satisfied with the volume of impact. It pushed us to take another look at the dynamics in the market and ask around, which led us to a slightly unobvious conclusion: the best way to fix the Series A chasm and get founders plugged in to institutional capital is by intervening earlier in the pipeline at the Seed round. There are a bunch of reasons why that is true and why it wasn’t obvious when we initially designed the program back in 2019.

One thing we kept running into is the semantic complexity of what defines a Seed versus a Series A round and how that’s been shifting. There’s now way more overlap and has become a less meaningful distinction given that Seed rounds are getting larger and resemble A rounds. Furthermore, VC’s who previously only invested at the A round have moved into those earlier rounds primarily so they don’t cut out of the deal flow in later rounds.

Now that we’ve made the move to expand the program to startups seeking Seed stage funding ($1M+), we’re seeing remarkable momentum that will enable us to help more founders, especially women and people of color who face added barriers for capital access.

From the beginning, this program has sought to expand capital access to all founders with great companies and teams. We started with a broad geographic service area including all of SoCal and have been able to directly assist startups based in West Hollywood, West LA, Downtown LA, Silicon Beach as well as in Santa Barbara, Ventura, Orange, Riverside, and San Diego counties.

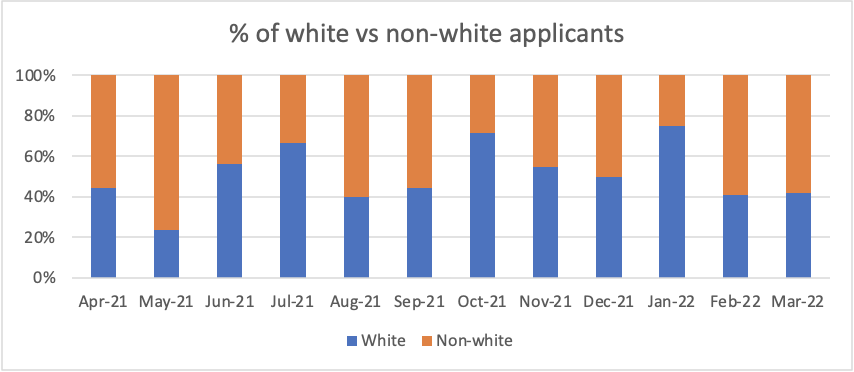

We’ve had more measured success in identifying underrepresented founders at the Series A stage. By moving to the earlier seed stage and closer to where underrepresented founders struggle most, we have already seen a huge uptick in the diversity of companies we can potentially help.

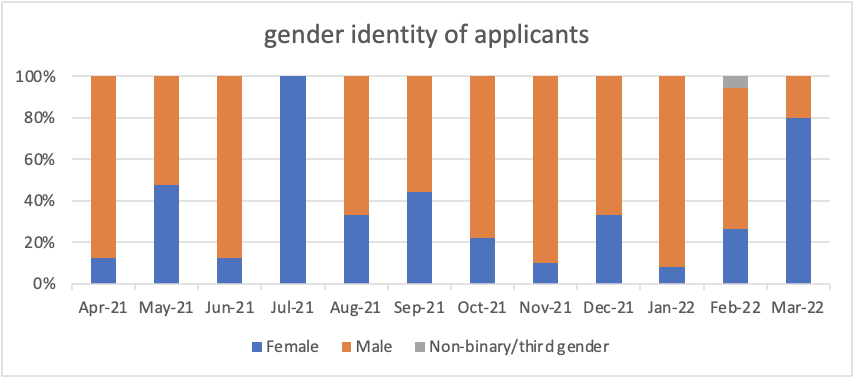

Since expanding our program in early February to include Seed stage companies, the proportion of non-white founders applying to the program is closer to 60% vs an average of 53% for the full year (see graphs below). We’ve seen a similar uptick for female founders although data suggests this will still be a difficult metric to change because even though women now make up more of the workforce, men possess 80% of C-suite positions.

According to Harvard Business Review, in 2019, women-led startups received only 2.8% of Venture Capital funding which was an all-time high. In 2021, a report showed that percentage decreased to 2.3%. Despite the fact that firms with more female executives perform better, and women led startups on average bring in higher revenue and deliver twice as much per dollar invested, we are still seeing a big gap in the market.

It makes sense (and the data supports this) that diverse founders have a harder time accessing capital at the early Seed stage so are not viable candidates for growth funding at the Series A round. Helping at the Seed stage (and even earlier) is where we’ll see the most improvement in supporting these under-accessed founders. We believe that those who have the power to change this dynamic by investing in underrepresented founders have a unique opportunity and even a responsibility to do so.

The SoCal Venture Pipeline program now has 16 total accepted companies, 2 of which have been funded, with VC intros to firms such as Vertical Ventures, Navigate Ventures, Bonfire, and many others. It’s a great start and we’re excited about the potential to help many more startups in our second program year.

If you are a SoCal based tech founder raising $1m+ of institutional capital, we want you to apply now.

About the Venture Pipeline Program

Our program is 100% free to founders: we take no fees, equity or compensation from startups. We are able to do this because of generous underwriting support by Silicon Valley Bank as well as law firms Wilson Sonsini Goodrich & Rosati, and KPPB LLP. Our goal is to democratize founder access to capital.

Over the past year we have developed relationships with the top accelerators, incubators, and ecosystem organizations across the region as well as a network of community leaders who recommend startups for the program. We have received over 130 startup applications which get reviewed and those that meet our ‘fundable’ criteria get personal, strategic introductions to VC’s as well as corporates and other valuable contacts.