Shifting Sands: A Discussion on Navigating the Ever-Changing Landscape of Funding in Today’s Startup Market

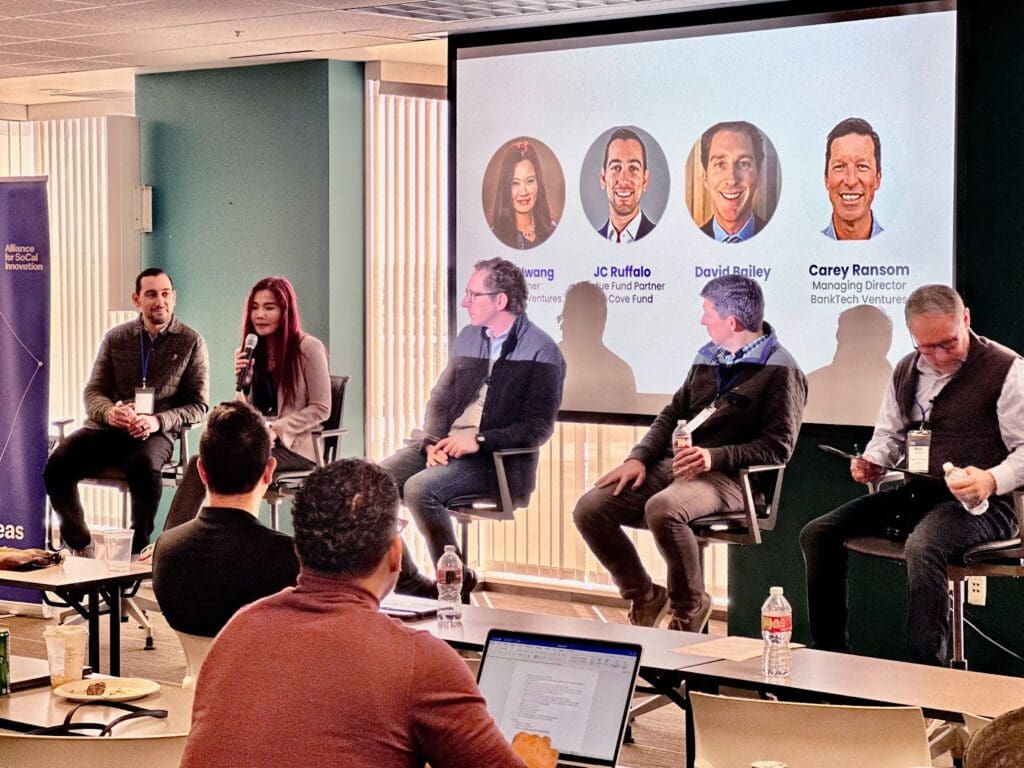

The world of venture capital is in flux, with profound implications for founders and funders alike. Earlier this month, we hosted a discussion with investors based in Orange County at the Microsoft Tech Center in Irvine to shed light on what’s really going on in the market and to provide concrete advice for founders raising capital. Founders gave the event high ratings and raved about the quality of the panel and the venue.

Kevin Orbaker, Chief Technology Architect at Microsoft Technology Center, kicked off the event by welcoming participants to the facility and highlighted some of the ways that Microsoft helps customers from various industries create and implement innovation solutions. Kevin later provided a tour of the facility which showcased Microsoft’s advanced capabilities that the company can bring to startups.

To set the stage for the investor panel that was to follow, Mark diTargiani of Pacific Western Bank shared recent venture statistics from Pitchbook, CB insights, and Amplify’s 2H 2022 Los Angeles Seed Deal Report. He noted that the average deal size in the region had fallen by about 10% year over year, down to around $4.17 million, and Blockchain deals had the largest average deal size at $6.21 million. Cleantech had seven deals in LA, while social media deals doubled from 4% to 8% of overall funding. Later-stage financing valuations had the most significant reset in 2022. Despite these changes, he noted that some of the best companies are launched in times of scarcity, and VC firms are still investing.

Panel members included investors JC Ruffalo of the Cove Fund, Pat Hwang of Heedfirst Ventures, Carey Ransom of Bank Tech Ventures, and IP attorney David Bailey of KPPB. They shared their views on the current state of the startup funding market. Ruffalo noted that he has never seen more deals in his life and that there is a lot of activity in the market, with many new companies being created. Hwang agreed that the market is more competitive but added that there is still a lot of funding available. However, entrepreneurs must be conscious of the valuations they are asking for and be willing to negotiate. Ransom noted that they are seeing a ton of interest in investing in computational biology, clean tech, and blockchain-related technologies.

Also discussed was the importance of timing in fundraising, and they emphasized the significance of building relationships and doing homework on potential investors to know their focus and check sizes. Fundraising founders should know their target audience and market, build a network, and establish points on the line that can be connected to show progress to potential investors. Panelists stressed that founders should focus on milestones instead of “when” to raise money because there is no perfect timing. However, having a good product and good product fit is essential, and while there isn’t an ideal time, founders should start connecting with investors early, even if they are bootstrapping. It’s all about building relationships.

Another topic touched on was the use of technology in evaluating the potential success of a startup, including algorithms that predict whether a CEO is a good fit for a company. Panelists stressed the importance of being ready to pitch when asking for introductions to potential investors and leveraging your network for further introductions. Also emphasized was the importance of conveying the right messaging that creates excitement and emotion when pitching to investors. The power of the story and the ability to hook someone in at the beginning is crucial.

The conversation also delved into whether it’s better to raise a round on an equity crowdfunding platform or pitch to institutional or traditional investors. The consensus was that it depends on what the founder is trying to accomplish and that it starts with the story. If the story is accessible to a broad range of people and aligns with a large army of potential investors, crowdfunding might be a viable way to go.

The meaning of the term “thesis” in the context of venture capital was another topic discussed. It can refer to a fund’s investment strategy, which can be based on a particular industry or technology the fund believes will succeed. Founders should thoroughly understand a fund’s investment strategy to determine if there is alignment between their company and the fund’s investment goals.

Startup valuation was another point in the discussion. Pat Hwang advised that valuations must be realistic and not seem greedy or out of touch with the market. She mentioned that founders must be proactive, persistent, and willing to learn and adapt as they work to close their rounds. While the market may change, there will always be opportunities for innovative and driven founders to build great companies.

In conclusion, the panel discussion offered valuable insights into the current state of the tech fundraising market. The advice shared by the panelists can benefit both founders and investors. By highlighting the importance of focus, diligence, and adaptability in building successful companies, the panelists provided a roadmap for those currently raising seed or Series A funding rounds. Despite the layoffs and challenges the tech market may face, the future looks promising, thanks to the resilience and innovation of startup ecosystems like ours here in SoCal.

If you’d like to learn from some of the industry’s most successful entrepreneurs and investors, get in touch. Our next founder-focused in-person event and investor panel discussion will be in Santa Barbara in late March. The Alliance also hosts regular AMAs (Ask Me Anything) webinars with investors to serve the SoCal founder community.