Navigating the Funding Landscape: A Guide to Pre-Seed, Seed, Series A, and Series B Financing Rounds for Startups

By Roger Roman

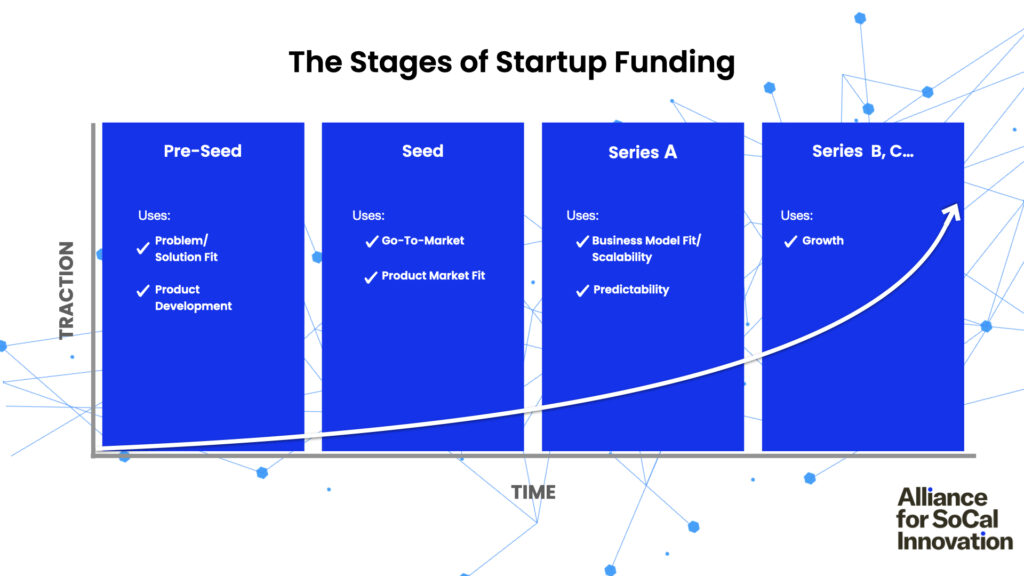

Starting a company is a journey; just like any journey, it needs a little financial fuel to keep it going. That’s where funding comes in. As a founder, you’ll search for various funding sources to support your startup’s growth. First up is the pre-seed round, followed by the seed, Series A and beyond. Understanding the differences between these funding rounds is key to securing the money your company needs to succeed. So buckle up; it’s time to hit the funding roller coaster!

Pre-Seed

Pre-seed funding– typically the first funding round for a startup– is used to develop a prototype or proof of concept. Typically smaller in size, this funding is essential for early-stage startups just starting to build their product or service. It also helps you get the necessary resources to develop a functional prototype and test their idea. The pre-seed round is the riskiest for investors. Pre-seed funding can come from many sources, including friends and family, angel investors, and crowdfunding campaigns.

Seed

The next funding stage is Seed, which is used to develop the product or service further and build a team. Typically larger than pre-seed funding, seed funding is used to help startups refine their product or service based on in-depth customer interaction and build a solid foundation for growth. Investors take on less risk at this stage. Seed funding usually ranges from $250,000 to $2 million and is generally provided by angel investors and early-stage venture capital firms. For the SoCal Venture Pipeline program we consider $1M to be the low end for Seed stage.

Series A

Series A funding is the first round of institutional funding for a startup. At this stage, with a growing customer base and revenue flowing, the startup has typically developed a product or service and has some traction. Usually larger than seed funding, this round’s influx is used to help startups scale their business and expand operations. Investors take on even less risk at this stage. For Series A funding typically ranges from $2 million to $15 million and is provided by venture capital firms (note: our program threshold starts at $4M for Series A).

Series B

Series B funding is the next stage of institutional funding for a startup. This investment is generally used to accelerate growth and scale the business. Larger than Series A funding, Series B funds help startups expand into new markets and grow their customer base. Investors take the slightest risk at this stage. Series B funding typically ranges from $7 million to $30 million and is also provided by venture capital firms.

Conclusion

To summarize, pre-seed and seed funding help you develop and validate your product or service, while Series A and B funding give you the boost you need to scale your business. Understanding the differences between these rounds is essential to give yourself the best chance of securing an investment.

Riding the fundraising rollercoaster can be challenging, but with some knowledge and planning, you can secure the financial support you need to grow and succeed.

Roger Roman is the Venture Outreach Manager for the SoCal Venture Pipeline Program. Roger is a tech entrepreneur, investor, and mentor who co-founded startup AfriBlocks, which was selected as a SVP company. Prior to Afriblocks, Roger served as the Managing Partner of Push Consulting & Marketing, a growth marketing, and business development consulting agency. As a consultant, he guided fledgling startups from launch to acquisition and helped enterprise clients such as Nike, Universal Music Group, and Apple Music drive online visibility and growth. In addition to being a founder, Roger is also an angel investor and VC scout; throughout his career, he has maintained a commitment to supporting resilient founders and helping them build innovative startups.